13 Januari 2025

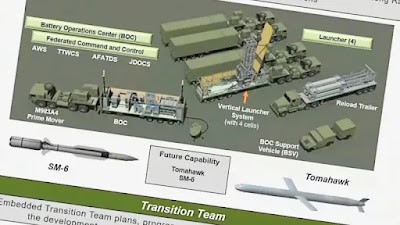

Filipina berkeinginan mendapatkan Typhon Mid-Range Capability sementara publik menebak-nebak sumber pendanaan dalam kerangka Horizon (infographic: US Army)

Kapal selam akan direalisasikan dengan anggaran dari Horizon 3 (photo: Hanwha Ocean)

ANGKATAN LAUT FILIPINA/PHILIPPINE NAVY (PN)

Horizon 1 (2013-2017)

1.Strategic Sealift Vessels (SSV): Dua kapal dibeli seharga PHP 4 miliar ($93 juta).

Penyelesaian: Dikirim di bawah Presiden Benigno Aquino III.

2.Frigate Surface-to-Air Missile (Horizon 1): Akuisisi sistem rudal untuk frigat yang ada.

Penyelesaian: Sebagian selesai di bawah Aquino, berlanjut di bawah Duterte.

Horizon 2 (2018-2022)

1.Frigat kelas Jose Rizal: Biaya sekitar PHP 18 miliar ($350 juta).

Penyelesaian: Dikirim di bawah Presiden Rodrigo Duterte.

2.Akuisisi Helikopter Anti Kapal Selam: helikopter AW159 Wildcat direncanakan, akuisisi tertunda ke Horizon 3.

Penyelesaian: Tidak selesai dalam Horizon 2.

3.Kapal selam: Rencana untuk memperoleh kapal selam telah didiskusikan tetapi dipindahkan ke Horizon 3 karena pendanaan.

4.Kapal patroli Shaldag Mk V: Akuisisi sembilan unit sekitar PHP 10 miliar ($ 200 juta), dengan transfer teknologi untuk produksi lokal.

Penyelesaian: Pengiriman dimulai di bawah Duterte, dengan beberapa unit ditugaskan pada 2022.

Horizon 3 (2023-2028)

1.BrahMos Supersonic Cruise Missiles: Akuisisi untuk Korps Marinir Filipina (di bawah Angkatan Laut), biaya $ 375 juta untuk tiga baterai.

Penyelesaian: Pengiriman awal dimulai pada tahun 2024 di bawah Presiden Ferdinand Marcos Jr.

2.Corvettes kelas Miguel Malvar: Dua unit di bawah Corvette Acquisition Program (CAP), senilai PHP 28 miliar ($550 juta).

Penyelesaian: Pemotongan baja dan peletakan keel selesai, diharapkan pengiriman pada tahun 2025 dan 2026 di bawah Marcos Jr.

3.Kapal patroli lepas pantai (OPV): Enam unit direncanakan untuk dibeli pada PHP 30 miliar ($ 590 juta), untuk menggantikan aset era Perang Dunia II.

Penyelesaian: Kontrak ditandatangani di bawah Duterte, konstruksi dan pengiriman diharapkan di Horizon 3 di bawah Marcos Jr.

Penambahan fregat/korvet akan dilakukan dengan Re-Horizon 3 (photo: HD)

Re-Horizon 3 Proyek Angkatan Laut

Fokus pada perolehan lebih banyak kapal, termasuk korvet, kapal patroli, dan kapal selam yang berpotensi.

Total Anggaran: Hingga US$35 miliar selama dekade berikutnya.

Penyelesaian: Proyek dalam tahap perencanaan.

ANGKATAN UDARA FILIPINA/PHILIPPINE AIR FOECE (PAF)

Horizon 1 2013-2017)

1.FA-50 Light Jet Fighters: 12 unit seharga US$ 420 juta.

Penyelesaian: Dikirim di bawah Presiden Benigno Aquino III.

2.C-130T Hercules: Diperbaharui dan diperoleh untuk mobilitas udara.

Penyelesaian: Selesai di bawah Aquino.

3.A-29B Super Tucano: Enam pesawat seharga sekitar $100 juta.

Penyelesaian: Dikirim di bawah Aquino.

Horizon 2 (2018-2022)

1.Helikopter S-70i Black Hawk: 16 unit seharga $240 juta.

Penyelesaian: Dikirim di bawah Presiden Rodrigo Duterte.

Horizon 3 (2023-2028)

1.Tambahan 32 Helikopter Black Hawk S-70i: Akuisisi untuk PHP 32 miliar ($624 juta).

Penyelesaian: Batch pertama diperkirakan pada tahun 2023 dengan pengiriman penuh pada tahun 2025 di bawah pemerintahan Duterte dan Marcos Jr.

2.Tambahan A-29B Super Tucano: Akuisisi 6 unit lagi untuk meningkatkan kemampuan dukungan udara dekat.

Biaya: Tidak ditentukan, diharapkan dalam anggaran Horizon 3.

Penyelesaian: Rencananya di bawah Marcos Jr.

3.Helikopter T-129 ATAK: Rencana pembelian 6 unit seharga sekitar $300 juta, tidak selesai dalam Horizon 2, pindah ke Horizon 3.

Status: Proyek tertunda ke Horizon 3.

4.Tambahan Helikopter ATAK T-129: Akuisisi 6 unit tambahan untuk meningkatkan armada helikopter serang.

Biaya: Sekitar $300 juta untuk unit tambahan.

Penyelesaian: Diharapkan akan diselesaikan dan dikirim di bawah Marcos Jr.

5.Pesawat Tempur Multirole: Diskusi untuk pesawat tempur baru, dipindahkan ke daftar keinginan Horizon 3.

Status: Perencanaan di bawah Marcos Jr.

Filipina juga berkeinginan menambah jumlah pesawat tempur multirole dengan Re-Horizon 3 (photo: EDaily Korea)

Re-Horizon Proyek Angkatan Udara

Termasuk pesawat tempur multirole, helikopter tambahan, dan sistem radar.

Total Anggaran: Bagian dari US$35 miliar selama dekade berikutnya.

Penyelesaian: Tahap perencanaan di bawah Marcos Jr.

Rudal BrahMos akan direalisasikan dengan anggaran dari Horizon 3 kali ini untuk Angkatan Darat (photo: ANI)

Horizon 1 2013-2017)

1.M113 Firepower Upgrade: Peningkatan ke pembawa personil lapis baja M113 yang ada.

Penyelesaian: Sebagian selesai di bawah Aquino, berlanjut di bawah Duterte.

2.Rocket Launcher Light Phase 2: Akuisisi peluncur roket untuk pasukan darat.

Penyelesaian: Selesai di bawah Aquino.

Horizon 2 (2018-2022)

1.Peningkatan Sistem Armor Ringan: Proyek bersama dengan Angkatan Laut untuk peningkatan baju besi ringan.

Penyelesaian: Sedang berlangsung, dengan penyelesaian sebagian di bawah Duterte.

2.Designated Marksman Rifle: Akuisisi senapan presisi.

Penyelesaian: Beberapa pembelian selesai di bawah Duterte.

Peralatan Perlindungan Angkatan: Baju besi tubuh, helm, dll., untuk personil Angkatan Darat.

Penyelesaian: Sebagian selesai.

Horizon 3 (2023-2028)

1.BrahMos Supersonic Cruise Missiles: Berencana bagi Angkatan Darat untuk memperoleh dua baterai BrahMos untuk pertahanan pantai, biaya tidak ditentukan tetapi bagian dari anggaran modernisasi.

Penyelesaian: Pengiriman yang diharapkan di cakrawala ketiga, disetujui di bawah Marcos Jr.

Re-Horizon 3 Proyek Angkatan Darat

Fokus pada peningkatan kemampuan darat dengan peralatan yang lebih canggih, Artileri, dan kemungkinan tank ringan.

Total Anggaran: Termasuk dalam US$35 miliar selama dekade berikutnya.

Penyelesaian: Dalam perencanaan di bawah Marcos Jr.

Kredit untuk Presidensi

Benigno Aquino III - Memulai dan menyelesaikan banyak proyek di Horizon 1.

Rodrigo Duterte - Melihat penyelesaian proyek Horizon 2 dan melanjutkan beberapa dari Horizon 1, termasuk memulai batch pertama Black Hawks dan pembelian Shaldag.

Ferdinand Marcos Jr. - Menyetujui inisiatif "Re-Horizon 3", berfokus pada peningkatan komprehensif di semua cabang, termasuk pembelian yang signifikan seperti rudal BrahMos, korvet Malvar, OPV, tambahan Super Tucanos, helikopter T-129 ATAK, dan tambahan 32 Black Hawks.

Harap diperhatikan, biaya dan status penyelesaian mungkin sedikit berbeda karena rincian pembelian akhir, inflasi, dan faktor lainnya. Proyek sering menjangkau beberapa administrasi karena sifat panjang dari proses perolehan pertahanan.

BUKTI 42 RAFALE RESMI DASSAULT =

BalasHapus6 RAFALE SEPTEMBER 2022

18 RAFALE AGUSTUS 2023

18 RAFALE JANUARI 2024

DEFENSE STUDIES = 42 RAFALE

(Saint-Cloud) – 08 Januari 2024 The final tranche of 18 Rafale for Indonesia came into force today. It follows the entry into force, in September 2022 and August 2023, of the first and second tranches of 6 and 18 Rafale, thus completing the number of aircraft on order for Indonesia under the contract signed in February 2022 for the acquisition of 42 Rafale.

----

COMPLETE 42 RAFALE IDN

COMPLETE 42 RAFALE IDN

COMPLETE 42 RAFALE IDN

the final tranche of 18 Rafale aircraft for Indonesia came into force on January 8, 2024. This completes the acquisition of the 42 Rafale aircraft that Indonesia ordered in February 2022. The first and second tranches of 6 and 18 Rafale aircraft entered into force in September 2022 and August 2023, respectively.

----

2 FALCON 8x = VVIP TRANSPORT

2 FALCON 8x = VVIP TRANSPORT

7x AND 8x = INTERIM PLANES FOR FAMILIARIZATION AND TRAINING

Indonesian Air Force: Two Falcon 8X, delivered as part of the first batch of the Indonesian Dassault Rafale contract. Previously the Indonesian Air Force operated one Falcon 7X and one Falcon 8X as interim planes for familiarization and training, stationed in 17th Air Squadron for VVIP transport

==========

==========

1 PPA TOTAL VOLCANO = 56 UNIT

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

The OTO Melara 127mm/64cal Lightweight (LW) on the GP variant is part of the VULCANO system which consists of four key sub-systems: the medium caliber 127/64 LW Gun assembly, the Automated Ammunition Handling System, the Naval Fire Control Support and the VULCANO family of ammunition. The system is intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The 127/64 LW - VULCANO is equipped with a modular feeding magazine, composed by 4 drums with 14 ready to fire ammunition each (56 in total), reloadable during firing, and highly flexible in terms of selection of ammunition, independently from their position in the drums. Ammunition flow is reversible as rounds can be downloaded automatically. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km. The rate of fire is 32rds per minute. General Purpose FREMMs are getting the highly Automated Ammunition Handling System for the 127/64 mm gun, which holds 350 127mm shells in addition to the 56 in the four reload drums of the gun turret.

----

GOODBYE = LEKIU KASTURI LAKSAMANA KEDAH PERDANA HANDALAN JERUNG LMS LCS

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

According to Oto Melara, the 127/64 LW is a state of art medium caliber gun suitable for installation on large and medium size ships and intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The compactness of the gun feeding system makes possible the installation on narrow section crafts. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km.

----

EXOCET MM40 (surface-launched) – Block 1, Block 2 and Block 3: deployed on warships and in coastal batteries. Range: 72 km for the Block 2, in excess of 200 km for the Block 3

----

TNI AL = BLOCK 3 : 200 KM

----

TLDM = BLOCK 2 : 72 KM

----

PERDANA MENTERI = DEFACT KILL PREGNANT WOMEN

LCS = STALLED 13 YEARS

LMS B1 = GUNBOAT NO MISSILE

LMS B2 = DOWNGRADE HISAR OPV

LEKIU = EXO B2 EXPIRED

KASTURI = EXO B2 EXPIRED

LAKSAMANA = GUNBOAT NO MISSILE

KEDAH = GUNBOAT NO MISSILE

PERDANA = GUNBOAT NO MISSILE

HANDALAN = GUNBOAT NO MISSILE

JERUNG = GUNBOAT NO MISSILE

2.Akuisisi Helikopter Anti Kapal Selam: helikopter AW159 Wildcat direncanakan, akuisisi tertunda ke Horizon 3.

BalasHapusPenyelesaian: Tidak selesai dalam Horizon 2.

---------

Lah AW159 jadi akusisi kok, malah uda datang, aktif operasi ..wah berita Salah ini haha!😵💫😵💫😵💫

2018 aja uda dateng, ntar ente diomelin om max min haha!😋😋😋

Hapus⬇️⬇️⬇️

https://defense-studies.blogspot.com/2018/10/phl-navy-pilots-now-training-for-2.html?m=1

Pinoy udah pake AW-159.....malah udah OPS di geladak fregat buatan Koryo kok ☝️

HapusUntuk FMP, Kalok kita sih udah mantep pilih heli AKS yg lebih gambot dari Panther supaya momotannya makin besar 😱😱😱

https://youtu.be/HjLiRQNpAQ4?si=d1vi_GGfL8eTSurh

FMP ntar awewe101...percayalah haha!🥰🥰🥰

HapusWaooooow.....kalo awewe-101 gantungannya bisa kanan-kiri dong 😱😱😱

HapusDan kalo ewawa-010 gantungannya tengah bawah..🤤

HapusDalam diam ternyata diam - diam yang senyap ada kontribusi malaydesh dalam modernisasi militer philipina yaitu ikut pemasangan SELANG dan SEPTIC TANK diseluruh base camp militer pinoy, wow tentu saja ini project besar guys 😅🤣😂🤣😅🤣

BalasHapusDalam kontrak disebutkan bahwa malaydesh boleh mengambil ISI septic tank tersebut untuk bahan penelitian sebagai bahan roket tamingsari 🤣😅😂😅🤣😅

HapusKomentar ini telah dihapus oleh pengarang.

BalasHapussi miskin ta shooping...

BalasHapus😂😂😂😂🤣🤣🤣🤣🤣

ditempelengi terus di BTA..

🤣🤣🤣🤣🤣🤣

bertahun tahun..

maju utangnya.. iya.. bener itu.

BalasHapus🤣🤣🤣🤣

Sori Bro...... realisasinya belum sampai kesitu wong target MEF 3 nya belum terpenuhi kok 🤷🏻

BalasHapusAla ikut saja INDIANESIA... NGUTANG LENDER saja dia tahu .... 🔥🔥🤣🤣

BalasHapusutang itu tanda hubungan multilateral negara bagus dan terpercaya di dunia international..

Hapus, 😂😂😂😂😂😂

BODOH MALAYDESH..

🤣🤣🤣🤣🤣

UNREADY ARMED FORCES

HapusUNREADY ARMED FORCES

UNREADY ARMED FORCES

the Malonnn military is today the region’s weakest. It is riddled with corruption, poor planning, and interference by political leaders in procurement, no longer a potent force even in managing low-level intensity conflict at a time when tensions in the South China Sea are higher than they have been since the days of the Vietnam War.

A 2019 White Paper on Defense – nearly four years ago – called for more funds and punch as well as an overhaul of the procurement system to allow professionals to decide on what weapon systems they need. Instead, PM Anwar Ibrahim’s proposal to increase the defense budget by 10 percent to fund procurement will be delayed because of budgetary considerations related to the flagging economy, expected by the World Bank to grow at a mediocre 3.9 percent in 2023, down from an earlier estimate of 4.3 percent in April

===================

THE MALONN LITTORAL COMBAT SHIP (LCS) PROGRAM HAS FACED A NUMBER OF ISSUES, INCLUDING:

• Delayed delivery

The original plan was to deliver the first ship, the LCS 1 Maharaja Lela, in 2019, and all six ships by 2023. However, the program was stalled in 2019 due to financial issues at Boustead Naval Shipbuilding. The program was restarted in 2023, with the first ship scheduled for delivery in 2026 and the remaining four by 2029.

• Design issues

The Royal Malonn Navy (RMN) did not get to choose the design of the ship, and the detailed design was not completed until after 66.64% of the budget had been paid.

• Financial issues

Boustead Naval Shipbuilding was in a critical financial state, and a middleman increased the project cost by up to four times.

• Corruption

A declassified audit report highlighted irregularities in the execution of the program, including the abuse of power and the involvement of a Zainab Mohd Salleh.

• Aging fleet

The RMN's current fleet is outdated, with two-thirds of the ships dating back over 30 years

===================

THE MALONNN ARMED FORCES (MAF) FACES A NUMBER OF CHALLENGES, INCLUDING:

• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze

Transboundary haze has had a grave impact on economic and social activities in MalonnThe Royal Malonnn Air Force (RMAF) faces several problems, including:

• Fleet sustainment

The RMAF has faced challenges maintaining its fleet of aircraft. For example, in 2018, only four of the RMAF's 18 Sukhoi Su-30MKM aircraft were able to fly due to maintenance issues and a lack of spare parts.

• Technological obsolescence

Some aircraft in the RMAF's fleet are reaching technological obsolescence. For example, the Kuwaiti HORNET MALONNs are an earlier block of the HORNET MALONN, which may cause compatibility issues with spare parts.

• Modernization

The RMAF has ambitious plans to modernize its air capabilities to address current and future threats. However, the government's defense modernization budget is limited

FACT BUDGET 2025 ......

HapusNOT ASSETS = NO SHOPPING

NOT ASSETS = NO SHOPPING

NOT ASSETS = NO SHOPPING

SALARIES AND OTHER STUFF

PMX DS Anwar Ibrahim today announce an allocation of RM40.6 billion for the national security sector from the RM461 billion 2025 national budget. This is an increase of RM2 billion for the sector which includes Home and Defence ministries, from the 2024 budget of RM38.7 billion.

Defence got RM21.1 billion allocation, an increase of RM1.4 billion from last year, while Home will get RM19.5 billion, an increase of some RM500 million. Others have made the calculations that the Defence’s stake of the budget is 1.2 per cent of the Malonnn GDP. That said most of the allocation is FOR SALARIES AND OTHER STUFF AND NOT ASSETS.

Operational Expenditure for Defence in 2025 is RM13.363 billion while Development Expenditure is RM7.492 billion. The OE allocation is an increase of some RM1 billion while the increase in DE is around RM450 million. The highest increase in OE is for the emolument (salaries and allowances) which amounted to RM8.773 billion. It is interesting to note that the increase in DE is for services and supply (RM1.906 billion) while asset procurement is down to RM5.585 billion, down by some RM250 million from last year.

From the DE, the Army will be getting RM1.197 billion, of which RM218 million is for construction of new facilities and RM980 million is for assets. RMN is getting RM2.25 billion, RM150 million (facilities) and RM2.1 billion, assets. RM2.3 billion is for RMAF, RM65 million for facilities and RM2.2 billion for assets. For the three services, RM663 million is allocated.

-------------------------------------

FACT BUDGET 2025 ......

ASSET PROCUREMENT DOWN

ASSET PROCUREMENT DOWN

ASSET PROCUREMENT DOWN

Operational Expenditure for Defence in 2025 is RM13.363 billion while Development Expenditure is RM7.492 billion. The OE allocation is an increase of some RM1 billion while the increase in DE is around RM450 million. The highest increase in OE is for the emolument (salaries and allowances) which amounted to RM8.773 billion. It is interesting to note that the increase in DE is for services and supply (RM1.906 billion) WHILE ASSET PROCUREMENT IS DOWN TO RM5.585 BILLION, DOWN BY SOME RM250 MILLION FROM LAST YEAR

From the DE, the Army will be getting RM1.197 billion, of which RM218 million is for construction of new facilities and RM980 million is for assets. RMN is getting RM2.25 billion, RM150 million (facilities) and RM2.1 billion, assets. RM2.3 billion is for RMAF, RM65 million for facilities and RM2.2 billion for assets. For the three services, RM663 million is allocated.

==============

MALONN ARMED FORCES (MAF) FACES SEVERAL CHALLENGES WITH MAINTAINING ITS EQUIPMENT, INCLUDING:

1. Budget

The MAF has a limited budget, which affects the serviceability of its assets.

2. Outsourcing

The MAF has outsourced maintenance of its assets since the 1970s, but the outsourcing program has faced challenges such as undertrained staff, underperforming contractors, and lack of contract enforcement.

3. Old inventory

The Royal Malonn Navy (RMN) has a number of old ships in service, including the Kasturi-class Corvette, the Laksamana Corvette class, the Perdana-class gunboat, and the Handalan and Jerung class.

4. Spare parts

There are issues with delivering spare parts to soldiers on the ground at the right time

-------------------------------------

KEYWORDS BUDGET 2025 :

1. SALARIES AND OTHER STUFF

2. NOT ASSETS = NO SHOPPING

3. ASSET PROCUREMENT DOWN

Pinoy makin siap rebut Sabah dan Sarawak dengan restu kawasan. Malon cuma bual dan ngamuk sepi berita bermutu.

HapusIndonesia akan bantu pinoy untuk invasi negara anjingng malingsia

HapusKENAPA MALAYDESH TIDAK TERKENAL BAHKAN PEMAIN BOLA SEPAK PUN DARI BRITISH BERTANYA

BalasHapusDIMANA MALAYDESH..???

🤣🤣🤣🤣🤣

MALAYDESH? Aaminn!!

BalasHapusTeruskan berdoa...semoga warga bangladesh mengisi pekerjaan warga Konoha di Malaysia. Amin!!

🤣🤣🤣🤣🤣🤣

https://www.tiktok.com/@joeonnmalaysia/video/7445552508920990983

BAGUUUS...

HapusDEVISA KAMI LANCAR JAYA..

🤣🤣🤣🤣🤣🤣

PEPATAH JAWA LELUHUR KAMI..

"NGAPLOK NYELEH TANGAN"

MENJAJAH NEGERI LAIN TAPI BANGSA ORANG LAIN DISALAHKAN..

INILAH KAMI..

🤣🤣🤣🤣🤣🤣

DASAR BODOH..

🤣🤣🤣🤣🤣🤣🤣🤣

The Malonnn Armed Forces (MAF) faces a number of challenges, including:

Hapus• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze

Transboundary haze has had a grave impact on economic and social activities in MalonnThe Royal Malonnn Air Force (RMAF) faces several problems, including:

• Fleet sustainment

The RMAF has faced challenges maintaining its fleet of aircraft. For example, in 2018, only four of the RMAF's 18 Sukhoi Su-30MKM aircraft were able to fly due to maintenance issues and a lack of spare parts.

• Technological obsolescence

Some aircraft in the RMAF's fleet are reaching technological obsolescence. For example, the Kuwaiti HORNET MALONNs are an earlier block of the HORNET MALONN, which may cause compatibility issues with spare parts.

• Modernization

The RMAF has ambitious plans to modernize its air capabilities to address current and future threats. However, the government's defense modernization budget is limited

=========

A400M

PEMBAYARAN BERPERINGKAT = HUTANG

PEMBAYARAN BERPERINGKAT = HUTANG

PEMBAYARAN BERPERINGKAT = HUTANG

Malon membeli pesawat Airbus A400M secara ansuran dan bukan secara tunai. Pembelian pesawat A400M dilakukan melalui kontrak yang melibatkan pembayaran berperingkat.

----

FA50M SAWIT

On the other hand, South Korea aims to sell another 18 FA-50s to Malon in the future. Malon announced that at least half of the payment would be made in palm oil

----

SCORPENE SAWIT

Under the deal, France would buy RM819 million’s (€230 million) worth of Malonn palm oil, RM327 million (€92 million) of other commodities, and invest RM491 million (€138 million) for training and technology transfer to local firms here.

----

PT91 SAWIT KARET

Payment for the purchase includes 30 percent of direct off-set in the form of training and technology transfer and 30 percent of indirect off-set in commodities like palm oil and rubber.

----

ANKA = WILL NOT BE EQUIPPED WITH ANY WEAPONRY

Malonn to use Anka-S for Maritime Surveillance, and will NOt be equipped with any weaponry.

=========

17 CREDITOR LCS

17 CREDITOR LCS

17 CREDITOR LCS

1. MTU Services Ingat Kawan (M) Sdn Bhd

2. include Contraves Sdn Bhd

3. Axima Concept SA

4. Contraves Advanced Devices Sdn Bhd

5. Contraves Electrodynamics Sdn Bhd and Tyco Fire

6. Security & Services Malon Sdn Bhd,

7. iXblue SAS

8. iXblue Sdn Bhd and Protank Mission Systems Sdn Bhd

9. Bank Pembangunan Malon Bhd

10. AmBank Islamic Bhd

11. AmBank (M) Bhd

12. Affin Hwang Investment Bank Bhd

13. Bank Muamalat Malon Bhd

14. Affin Bank Bhd

15. Bank Kerjasama Rakyat Malon Bhd

16. Malayan Banking Bhd (Maybank)

17. KUWAIT FINANCE HOUSE (MALON) BHD.

MALAYDESH? Aaminn!!

BalasHapusTerima kasih kerana terus berdoa... Semoga warga Bangla dapat menggantikan warga KONOHA di Malaysia.

Warga Bangla lebih jujur, amanah dan tidak menipu berbanding warga KONOHA di Malaysia.

🤣🤣🤣🤣🤣🤣

https://www.tiktok.com/@joeonnmalaysia/video/7445552508920990983

A400M

HapusPEMBAYARAN BERPERINGKAT = HUTANG

PEMBAYARAN BERPERINGKAT = HUTANG

PEMBAYARAN BERPERINGKAT = HUTANG

Malon membeli pesawat Airbus A400M secara ansuran dan bukan secara tunai. Pembelian pesawat A400M dilakukan melalui kontrak yang melibatkan pembayaran berperingkat.

----

FA50M SAWIT

On the other hand, South Korea aims to sell another 18 FA-50s to Malon in the future. Malon announced that at least half of the payment would be made in palm oil

----

SCORPENE SAWIT

Under the deal, France would buy RM819 million’s (€230 million) worth of Malonn palm oil, RM327 million (€92 million) of other commodities, and invest RM491 million (€138 million) for training and technology transfer to local firms here.

----

PT91 SAWIT KARET

Payment for the purchase includes 30 percent of direct off-set in the form of training and technology transfer and 30 percent of indirect off-set in commodities like palm oil and rubber.

----

ANKA = WILL NOT BE EQUIPPED WITH ANY WEAPONRY

Malonn to use Anka-S for Maritime Surveillance, and will NOt be equipped with any weaponry.

=========

17 CREDITOR LCS

17 CREDITOR LCS

17 CREDITOR LCS

1. MTU Services Ingat Kawan (M) Sdn Bhd

2. include Contraves Sdn Bhd

3. Axima Concept SA

4. Contraves Advanced Devices Sdn Bhd

5. Contraves Electrodynamics Sdn Bhd and Tyco Fire

6. Security & Services Malon Sdn Bhd,

7. iXblue SAS

8. iXblue Sdn Bhd and Protank Mission Systems Sdn Bhd

9. Bank Pembangunan Malon Bhd

10. AmBank Islamic Bhd

11. AmBank (M) Bhd

12. Affin Hwang Investment Bank Bhd

13. Bank Muamalat Malon Bhd

14. Affin Bank Bhd

15. Bank Kerjasama Rakyat Malon Bhd

16. Malayan Banking Bhd (Maybank)

17. KUWAIT FINANCE HOUSE (MALON) BHD.

=========

LENDER = SHOPPING

PUBLIC DEBT MALONN = DEFENCE SPENDING

PUBLIC DEBT MALONN = DEFENCE SPENDING

PUBLIC DEBT MALONN = DEFENCE SPENDING

The results reveal a robust positive association between Public Debt and Defence Spending, substantiated by the significant coefficient of 0.7601 (p < 0.01). This suggests that an increase in Public Debt corresponds to a substantial rise in Defence Spending. Additionally, the study underscores the influence of Gross Domestic Saving and Exchange Rate on Defence Spending, with coefficients of 1.5996 (p < 0.01) and 0.4703 (p < 0.05), respectively. These findings contribute valuable insights into the fiscal dynamics of Malon's defence budget, shedding light on the interplay between Public Debt and strategic resource allocation. The incorporation of control variables enhances the robustness of the analysis, providing a nuanced understanding of the factors shaping defence spending in the Malonn context.

=========

2024 RASIO HUTANG 84,2% DARI GDP

HUTANG 2023 = RM 1.53 TRILLION

HUTANG 2022 = RM 1.45 TRILLION

HUTANG 2021 = RM 1.38 TRILLION

HUTANG 2020 = RM 1.32 TRILLION

HUTANG 2019 = RM 1.25 TRILLION

HUTANG 2018 = RM 1.19 TRILLION

The Finance Ministry stated that the aggregate national household debt stood at RM1.53 trillion between 2018 and 2023. In aggregate, it said the household debt for 2022 was RM1.45 trillion, followed by RM1.38 trillion (2021,) RM1.32 trillion (2020), RM1.25 trillion (2019) and RM1.19 trillion (2018). “The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said..

=========

FACT :

1. 1 UNIT APACHE = 13 UNIT MD530G

2. 1 UNIT RAFALE = 4 UNIT FA50M

3. 1 UNIT PPA = 3 UNIT LMS B2

4. 1 UNIT SCORPENE IDN = 2 UNIT SCORPENE MALONN

5. CN 235 US$ 27,50 JUTA = ATR 72 US$24.7 JUTA

6. SEWA 28 HELI = 119 HELI BARU

7. 4.5 KM JAVELIN = 1 KM NLAW

8. ANKA ISR NOT ARMED

Kenapa cemburu ke? 🤣🤣🤣🤣

BalasHapusBetul sangat, Negara Maju

BalasHapusMaju membualnya..

🤪🤪😂😂🤣🤣😛

Dulu saya tampal gambar kat bawah, maka ada warga KONOHA kata senyum aje dikatakan beli.

BalasHapushttps://i0.wp.com/defencesecurityasia.com/wp-content/uploads/2024/11/FB_IMG_1732033767976.jpg?resize=768%2C1024&ssl=1

Rupanya doa warga KONOHA itu hampir maqbul. Memang Malaysia dalam perancangan dapatkan Su-57!

https://twentytwo13.my/malaysia-likely-to-get-russian-stealth-fighters-under-14th-malaysia-plan/

Kontrak kami tiada PSP. Kontrak kami berisi. 🤣🤣🤣🤣🤣🤣

BUDGET 2025 = SALARIES AND ALLOWANCES

HapusBUDGET 2025 = NOT ASSETS

BUDGET 2025 = NOT ASSETS

BUDGET 2025 = NOT ASSETS

Defence got RM21.1 billion allocation, an increase of RM1.4 billion from last year, while Home will get RM19.5 billion, an increase of some RM500 million. Others have made the calculations that the Defence’s stake of the budget is 1.2 per cent of the Malonn GDP. That said most of the allocation is for salaries and other stuff and not assets.

==============

BUDGET 2025 = ASSET PROCUREMENT DOWN

BUDGET 2025 = ASSET PROCUREMENT DOWN

BUDGET 2025 = ASSET PROCUREMENT DOWN

Operational Expenditure for Defence in 2025 is RM13.363 billion while Development Expenditure is RM7.492 billion. The OE allocation is an increase of some RM1 billion while the increase in DE is around RM450 million. The highest increase in OE is for the emolument (salaries and allowances) which amounted to RM8.773 billion. It is interesting to note that the increase in DE is for services and supply (RM1.906 billion) WHILE ASSET PROCUREMENT IS DOWN TO RM5.585 BILLION, DOWN BY SOME RM250 MILLION FROM LAST YEAR

==============

Malonn has faced several crises, including political, financial, and economic crises:

• Political crisis

From 2020–2022, Malonn experienced a political crisis that led to the resignation of two Prime Ministers and the collapse of two coalition governments. The crisis was caused by political infighting, party switching, and the refusal of Prime Minister Mahathir Mohamad to transition power to Anwar Ibrahim. The crisis ended in 2022 with a snap general election and the formation of a coalition government.

• Financial crisis

Malonn experienced a financial crisis when the country's economic fundamentals appeared strong, but the crisis came suddenly. The government's initial response was to increase interest rates and tighten fiscal policy, but this was not enough to correct the external imbalances.

• Economic crisis

Malonn's economy has faced challenges due to weak global demand and a dependence on exports. In 2020, Malonn's economy shrank by the most since the Asian crisis. In 2023, weak global demand for electronics and a decline in energy prices weighed on the economy.

• Household debt crisis

As of the end of 2023, Malonn's household debt-to-GDP ratio was 84.2%, with household debt reaching RM1.53 trillion

Malonn has faced several rice crises in the past, including in 1973–1975, the 1980s, 1997–1998, 2008, and 2023. These crises are often caused by price hikes, which are driven by supply and demand, as well as market player behavior

=========

Malonn has a number of weaknesses, including:

• Economic

Malonn's budget income is highly dependent on the oil and gas sector, and fiscal revenues are low. The country also has high levels of household and corporate debt, and a high dependency on food imports.

• Political

Malonn has a divided political landscape, and the country has experienced political instability since 2018. The 2022 election resulted in a hung parliament, the first time this has happened since Malonn's independence.

• Environmental

Malonn ranks 147 out of 210 economies on the Environmental Sustainability Index, due to challenges with climate change vulnerability, recycling rate, and renewable electricity output.

• Public procurement

Some weaknesses in public procurement in Malonn include non-compliance with contract terms, delayed project completion, poor documentation, and low quality of products and services.

• Property market

In the second half of 2023, sales volumes in the property market declined, and prices rose by only 0.1% year-on-year.

• Currency

The Malonnn ringgit (MYR) could potentially go down in value further. A weaker currency can have negative economic impacts, particularly for businesses that rely on imports.

Mimpi malaydoggy boleh dapat su 57 mimpi yang bodoh 😝

HapusYup?

BalasHapusMALAYDESHYA..

Dengan hanya 10% pribumi Melayu, sisanya Bangla...🤣🤣😂😂😂😂

Lepas membual Hornet RONGSOKAN, sekejap membual SU-57

BalasHapus😂🤣🤣😛🤪🤪🤪

beli su 57..

BalasHapus🤣🤣🤣🤣

MALAYDESH TIDAK ADA MARTABAT DAN HARGA DIRI KERAJAAN..

BELI SU 57...

KECOAK PUN KETAWA...

🤣🤣🤣🤣🤣🤣

Beli?

HapusMaksudnya mengemis barter?

🤣🤣😂😂🤣😂🤣😂

YANG JELAS MELAYU MALAYDESH YANG TERJADI HARI ESOK..

HapusDI SEMENANJUNG..

RAJANYAPUN JADI AYAM KAMPUNG..

🤣🤣🤣🤣🤣🤣

YA TIDAK MAULAH 🇷🇺OM PUTIN

HapusBARTER CPO MALAYDESH..

SELAIN ITU 🇷🇺RUSSIAN CPO KE KITA MALAH MINTA DIBARTER SAMA BENSIN MURAH DARI 🇷🇺OM PUTIN KOK UNTUK CAMPURAN BIOFUEL..

🤣🤣🤣🤣🤣🤣

CPO NYA BUSUK DI AWANI NEWS..

🤣🤣🤣🤣

MALAYDESH = LITTLE DHAKA

BalasHapusMALAYDESH = LITTLE DHAKA

MALAYDESH = LITTLE DHAKA

KUALA LUMPUR: The bustling enclave known as 'Mini Dhaka' here is coming back to life. A survey by Harian Metro revealed that the area in Jalan Silang and Lebuh Pudu here was full of foreigners during the Chinese New Year public holiday. Every corner of the area in the city centre was packed with foreigners, mostly Bangladeshis...

-----------

2024 RASIO HUTANG 84,2% DARI GDP

HUTANG 2023 = RM 1.53 TRILLION

HUTANG 2022 = RM 1.45 TRILLION

HUTANG 2021 = RM 1.38 TRILLION

HUTANG 2020 = RM 1.32 TRILLION

HUTANG 2019 = RM 1.25 TRILLION

HUTANG 2018 = RM 1.19 TRILLION

The Finance Ministry stated that the aggregate national household debt stood at RM1.53 trillion between 2018 and 2023.

In aggregate, it said the household debt for 2022 was RM1.45 trillion, followed by RM1.38 trillion (2021,) RM1.32 trillion (2020), RM1.25 trillion (2019) and RM1.19 trillion (2018).

“The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said.

-

2024 OVER LIMIT DEBT 65,6%

Malon Government debt accounted for 65.6 % of the country's Nominal GDP in Mar 2024, compared with the ratio of 64.3 % in the previous quarter. Malon government debt to GDP ratio data is updated quarterly, available from Dec 2010 to Mar 2024.

------

84.2% DEBT TO GDP

HOUSEHOLD DEBT CRISIS

Malon's household debt is rising rapidly, with the debt-to-GDP ratio at 84.2% at the end of 2023. This is due to a combination of factors, including low wage growth, high living costs, and easy access to credit. The debt is a threat to the financial well-being of Malonns and the stability of the economy.

=============

2024 RINGGIT LOSSES

The ringgit extended its losses to end lower against the US dollar today despite weaker United States economic data, an economist said. At 6 pm, the ringgit depreciated to 4.7110/7145 versus the greenback from yesterday’s close of 4.7080/7110.

---

2023 RINGGIT FALLS

The Malonn ringgit has fallen to its lowest level since the 1997-1998 Asian financial crisis, with the currency weighed by the US dollar’s rise and a widening rate differential with the United States.

---

2024 DEFICIT 4.3% 2023 DEFICIT 5%

With Budget 2024, Malon’s military will get some but not all of what it wants, as the government runs a tight budget focused on uplifting the socio-economic well-being of citizens while trying to ensure fiscal discipline as it aims to narrow the deficit to 4.3% of GDP by end-2024 (from 5%)

---

2022 DEFICIT 5,6% 2021 DEFICIT 5,6%

Pada kesempatan yang sama, Menteri Ekonomi Malon Rafizi Ramli menyatakan pengeluaran negara cukup besar yang dipicu oleh pandemi untuk melindungi ekonomi memperlebar defisit menjadi 6,4 persen dari PDB pada 2021

Kemudian pada 2022 berkurang menjadi 5,6 persen, ketika pemerintah juga meningkatkan pagu utang dari 60 persen menjadi 65 persen dari PDB 70. POLIS SEWA 7 BELL429

MALAYDESH = LITTLE DHAKA

BalasHapusMALAYDESH = LITTLE DHAKA

MALAYDESH = LITTLE DHAKA

KUALA LUMPUR: The bustling enclave known as 'Mini Dhaka' here is coming back to life. A survey by Harian Metro revealed that the area in Jalan Silang and Lebuh Pudu here was full of foreigners during the Chinese New Year public holiday. Every corner of the area in the city centre was packed with foreigners, mostly Bangladeshis...

-----------

2024 RASIO HUTANG 84,2% DARI GDP

HUTANG 2023 = RM 1.53 TRILLION

HUTANG 2022 = RM 1.45 TRILLION

HUTANG 2021 = RM 1.38 TRILLION

HUTANG 2020 = RM 1.32 TRILLION

HUTANG 2019 = RM 1.25 TRILLION

HUTANG 2018 = RM 1.19 TRILLION

The Finance Ministry stated that the aggregate national household debt stood at RM1.53 trillion between 2018 and 2023.

In aggregate, it said the household debt for 2022 was RM1.45 trillion, followed by RM1.38 trillion (2021,) RM1.32 trillion (2020), RM1.25 trillion (2019) and RM1.19 trillion (2018).

“The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said.

-

2024 OVER LIMIT DEBT 65,6%

Malon Government debt accounted for 65.6 % of the country's Nominal GDP in Mar 2024, compared with the ratio of 64.3 % in the previous quarter. Malon government debt to GDP ratio data is updated quarterly, available from Dec 2010 to Mar 2024.

------

84.2% DEBT TO GDP

HOUSEHOLD DEBT CRISIS

Malon's household debt is rising rapidly, with the debt-to-GDP ratio at 84.2% at the end of 2023. This is due to a combination of factors, including low wage growth, high living costs, and easy access to credit. The debt is a threat to the financial well-being of Malonns and the stability of the economy.

=============

2024 RINGGIT LOSSES

The ringgit extended its losses to end lower against the US dollar today despite weaker United States economic data, an economist said. At 6 pm, the ringgit depreciated to 4.7110/7145 versus the greenback from yesterday’s close of 4.7080/7110.

---

2023 RINGGIT FALLS

The Malonn ringgit has fallen to its lowest level since the 1997-1998 Asian financial crisis, with the currency weighed by the US dollar’s rise and a widening rate differential with the United States.

---

2024 DEFICIT 4.3% 2023 DEFICIT 5%

With Budget 2024, Malon’s military will get some but not all of what it wants, as the government runs a tight budget focused on uplifting the socio-economic well-being of citizens while trying to ensure fiscal discipline as it aims to narrow the deficit to 4.3% of GDP by end-2024 (from 5%)

---

2022 DEFICIT 5,6% 2021 DEFICIT 5,6%

Pada kesempatan yang sama, Menteri Ekonomi Malon Rafizi Ramli menyatakan pengeluaran negara cukup besar yang dipicu oleh pandemi untuk melindungi ekonomi memperlebar defisit menjadi 6,4 persen dari PDB pada 2021

Kemudian pada 2022 berkurang menjadi 5,6 persen, ketika pemerintah juga meningkatkan pagu utang dari 60 persen menjadi 65 persen dari PDB

Pesawat latihan LCA saja mengemis barter 50%, malah mimpi SU-57..

BalasHapusSerius woeeiiy

🤣🤣😂😂🤣🤣🤪😛

Makanya saya kata, betul Malaydeshya jadi negara maju tuu tak salah...

BalasHapusMaju membualnya...🤣🤣😂😂🤪😛😛

maju waktunya ke arah bangkruuut...

Hapus🤣🤣🤣🤣

kalau bangkrut kita gak bisa ketawa lihat teriakan mereka..

BalasHapus🤣🤣🤣🤣

LENDER = MALON SHOPPING

BalasHapusPUBLIC DEBT MALONN = DEFENCE SPENDING

PUBLIC DEBT MALONN = DEFENCE SPENDING

PUBLIC DEBT MALONN = DEFENCE SPENDING

The results reveal a robust positive association between Public Debt and Defence Spending, substantiated by the significant coefficient of 0.7601 (p < 0.01). This suggests that an increase in Public Debt corresponds to a substantial rise in Defence Spending. Additionally, the study underscores the influence of Gross Domestic Saving and Exchange Rate on Defence Spending, with coefficients of 1.5996 (p < 0.01) and 0.4703 (p < 0.05), respectively. These findings contribute valuable insights into the fiscal dynamics of Malon's defence budget, shedding light on the interplay between Public Debt and strategic resource allocation. The incorporation of control variables enhances the robustness of the analysis, providing a nuanced understanding of the factors shaping defence spending in the Malonn context.

==============

2024 RASIO HUTANG 84,2% DARI GDP

“The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said.

==============

FACT GOVERNMENT ........

BUDGET 2025 = NOT APPROVE THE BUDGET REQUEST

BUDGET 2025 = NOT APPROVE THE BUDGET REQUEST

BUDGET 2025 = NOT APPROVE THE BUDGET REQUEST

RM11 billion annually also sounds reasonable if we look at the current US dollar exchange rate – US$2.5 billion – and the challenges ahead. But again, MAF has been let down by the government which has not say why it has not approve the budget requests. To me at least give us the reason why it has not try to meet the challenges faced by MAF. MAF acknowledges the conundrum which resulted in it coming out with the CAP 55 and 15 to 5 transformation plans. Despite this, the government has yet to stick to the plan and instead goes out of the way not to stick to it.

Yes, in the three terms he has been in power, PMX has given the highest DE budget for the last three decades. In 2023 he allocated RM6.041 billion, RM7.053 bilion and the latest RM7.492 billion. But it is still not enough to recover from the Covid years and the under-investment for the last three decades. Not when the MAF is still operating some 171 assets which are three decades old. Could he have given more to meet the defence budget? I have no idea, really as I am not purview to the government finances.

Unfortunately, recent events does not augur well for MAF. Can MAF recover in the next RMK? Only time will tell and if the world does not goes berserk first.

==============

BUDGET 2025 FOR ......

SALARIES AND OTHER STUFF

NOT ASSETS = NO SHOPPING

NOT ASSETS = NO SHOPPING

NOT ASSETS = NO SHOPPING

Defence got RM21.1 billion allocation, an increase of RM1.4 billion from last year, while Home will get RM19.5 billion, an increase of some RM500 million. Others have made the calculations that the Defence’s stake of the budget is 1.2 per cent of the Malonnn GDP. That said most of the allocation is FOR SALARIES AND OTHER STUFF AND NOT ASSETS.

ini kerajaan maju JOHOR..

BalasHapusPEMILIK JDT.. JANCUK DITAMBAH TAI..

jadi.. jooom..

https://youtu.be/BXop3dSc81Q?si=kjku1z_6MMKZpIeA

buanjirrr mendonia..

🤣🤣🤣🤣🤣🤣🤣

ini kerajaan maju om PS..

Hapus🤣🤣🤣🤣

Aah...itu video banjir di Bangla kale..

Hapus😂😂🤣🤣🤣😂😂🤣

Mangsa ==> banjir

Hapus🤣🤣🤣 bikin pusing bahasanya

paling aku suka warga malaydesh teriak teriak BBM NON SUBSIDI sama SEMBAKO 🤣🤣🤣🤣

Hapusudah gitu parlemen nya ramai dan anehnya semua buodoh akan solusi..

ya cuman pak anwar ibrahim itu aja yang SEUTUHNYA MANUSIA..

lainnya seperti hewan di kebon binatang..

🤣🤣🤣🤣🤣

MALAYDESH = LITTLE DHAKA

BalasHapusMALAYDESH = LITTLE DHAKA

MALAYDESH = LITTLE DHAKA

KUALA LUMPUR: The bustling enclave known as 'Mini Dhaka' here is coming back to life. A survey by Harian Metro revealed that the area in Jalan Silang and Lebuh Pudu here was full of foreigners during the Chinese New Year public holiday. Every corner of the area in the city centre was packed with foreigners, mostly Bangladeshis...

-----------

2024 RASIO HUTANG 84,2% DARI GDP

HUTANG 2023 = RM 1.53 TRILLION

HUTANG 2022 = RM 1.45 TRILLION

HUTANG 2021 = RM 1.38 TRILLION

HUTANG 2020 = RM 1.32 TRILLION

HUTANG 2019 = RM 1.25 TRILLION

HUTANG 2018 = RM 1.19 TRILLION

The Finance Ministry stated that the aggregate national household debt stood at RM1.53 trillion between 2018 and 2023.

In aggregate, it said the household debt for 2022 was RM1.45 trillion, followed by RM1.38 trillion (2021,) RM1.32 trillion (2020), RM1.25 trillion (2019) and RM1.19 trillion (2018).

“The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said.

-

2024 OVER LIMIT DEBT 65,6%

Malon Government debt accounted for 65.6 % of the country's Nominal GDP in Mar 2024, compared with the ratio of 64.3 % in the previous quarter. Malon government debt to GDP ratio data is updated quarterly, available from Dec 2010 to Mar 2024.

------

84.2% DEBT TO GDP

HOUSEHOLD DEBT CRISIS

Malon's household debt is rising rapidly, with the debt-to-GDP ratio at 84.2% at the end of 2023. This is due to a combination of factors, including low wage growth, high living costs, and easy access to credit. The debt is a threat to the financial well-being of Malonns and the stability of the economy.

=============

2024 RINGGIT LOSSES

The ringgit extended its losses to end lower against the US dollar today despite weaker United States economic data, an economist said. At 6 pm, the ringgit depreciated to 4.7110/7145 versus the greenback from yesterday’s close of 4.7080/7110.

---

2023 RINGGIT FALLS

The Malonn ringgit has fallen to its lowest level since the 1997-1998 Asian financial crisis, with the currency weighed by the US dollar’s rise and a widening rate differential with the United States.

---

2024 DEFICIT 4.3% 2023 DEFICIT 5%

With Budget 2024, Malon’s military will get some but not all of what it wants, as the government runs a tight budget focused on uplifting the socio-economic well-being of citizens while trying to ensure fiscal discipline as it aims to narrow the deficit to 4.3% of GDP by end-2024 (from 5%)

---

2022 DEFICIT 5,6% 2021 DEFICIT 5,6%

Pada kesempatan yang sama, Menteri Ekonomi Malon Rafizi Ramli menyatakan pengeluaran negara cukup besar yang dipicu oleh pandemi untuk melindungi ekonomi memperlebar defisit menjadi 6,4 persen dari PDB pada 2021

Kemudian pada 2022 berkurang menjadi 5,6 persen, ketika pemerintah juga meningkatkan pagu utang dari 60 persen menjadi 65 persen dari PDB

GDP INDONESIA = MALON+SINGA+PINOY

BalasHapusGDP INDONESIA = MALON+VIET+PINOY

GDP INDONESIA = MALON+THAI+VIET

GDP INDONESIA 1,492,618

GDP SINGA : 561,725

GDP MALON : 488,250

GDP PINOY : 471,516

GDP VIET : 468,400

GDP THAI : 545,341

WHY IS INDONESIA LISTED AS ONE OF THE G-20 COUNTRIES WHILE MALON AND SINGAPORE ARE NOT

Malon and Singapore lack the size to match Indonesia’s importance on the global stage. With a combined GDP of around $818 Billion, Malon and Singapore are still quite far from Indonesia’s $1.3 Trillion GDP, which puts a gap of around $500 Billion between Indonesia with Malon and Singapore. Without the combined GDP there would be a $900 billion gap between Indonesia with Malon and Singapore respectively.

Things get even worse when we measure the economy in GDP PPP. Indonesia stands at around $4 Trillion in PPP, whilst Malon at $1,089 Trillion and Singapore at $617 Billion. Even the combined GDP of the next three largest ASEAN nations (Thailand, Vietnam, and the Philippines) still couldn’t match Indonesia’s size. Within both PPP and Nominal GDP, no ASEAN nations are within the top 20 largest economies in the world, therefore none of them can qualify for the G20 membership with their GDP.

---------

BRICS

BRICS

BRICS is an intergovernmental organization comprising ten countries – Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates. BRICS was originally identified to highlight investment opportunities.....

==============

==============

DITOLAK INDIA MASUK BRICS

Laporan terbaru menunjukkan, India menolak gagasan ekspansi BRICS di 2024. Pemerintah Modi ingin menghentikan sementara penerimaan negara-negara baru termasuk Malonn selama lima tahun ke depan

---------

2024 RASIO HUTANG 84,2% DARI GDP

HUTANG 2023 = RM 1.53 TRILLION

HUTANG 2022 = RM 1.45 TRILLION

HUTANG 2021 = RM 1.38 TRILLION

HUTANG 2020 = RM 1.32 TRILLION

HUTANG 2019 = RM 1.25 TRILLION

HUTANG 2018 = RM 1.19 TRILLION

The Finance Ministry stated that the aggregate national household debt stood at RM1.53 trillion between 2018 and 2023.

In aggregate, it said the household debt for 2022 was RM1.45 trillion, followed by RM1.38 trillion (2021,) RM1.32 trillion (2020), RM1.25 trillion (2019) and RM1.19 trillion (2018).

“The ratio of household debt to gross domestic product (GDP) at the end of 2023 also slightly increased to 84.2% compared with 82% in 2018,” it said.

---------

Malonn has faced several crises, including political, financial, and economic crises:

• Political crisis

From 2020–2022, Malonn experienced a political crisis that led to the resignation of two Prime Ministers and the collapse of two coalition governments. The crisis was caused by political infighting, party switching, and the refusal of Prime Minister Mahathir Mohamad to transition power to Anwar Ibrahim. The crisis ended in 2022 with a snap general election and the formation of a coalition government.

• Financial crisis

Malonn experienced a financial crisis when the country's economic fundamentals appeared strong, but the crisis came suddenly. The government's initial response was to increase interest rates and tighten fiscal policy, but this was not enough to correct the external imbalances.

• Economic crisis

Malonn's economy has faced challenges due to weak global demand and a dependence on exports. In 2020, Malonn's economy shrank by the most since the Asian crisis. In 2023, weak global demand for electronics and a decline in energy prices weighed on the economy.

• Household debt crisis

As of the end of 2023, Malonn's household debt-to-GDP ratio was 84.2%, with household debt reaching RM1.53 trillion

• Malonn has faced several rice crises in the past, including in 1973–1975, the 1980s, 1997–1998, 2008, and 2023. These crises are often caused by price hikes, which are driven by supply and demand, as well as market player behavior....

Bwahahaha🤣🤣🤣, SU 57 guys tak salah dengar kah 😂😂😂

BalasHapusHorney aja bingung ngemis macam mana dengan SU 57 😂😂😂

MALONDESH kalau membual tak tanggung tanggung 😜😜😜

Pssstttt... Kapal OPV OMPONG PPA saja terpaksa NGUTANG.. MAHAL pula tu harga setara FREMM.. 🤣🤣🤣

BalasHapusKapal opv ppa dibekali rudal Aster untuk menembak pantat beruk malondoggy

HapusTahun 2025 Malondesh negara maju 😂😂😂

BalasHapusYang maju giginya 😜😜😜

Masa kapal PPA versi NGUTANG LENDER... LIGHT PLUS OMPONG seharga hampir setara FREMM FULL COMBAT... 🔥🔥🤣🤣

BalasHapusUNREADY ARMED FORCES

HapusUNREADY ARMED FORCES

UNREADY ARMED FORCES

the Malonnn military is today the region’s weakest. It is riddled with corruption, poor planning, and interference by political leaders in procurement, no longer a potent force even in managing low-level intensity conflict at a time when tensions in the South China Sea are higher than they have been since the days of the Vietnam War.

A 2019 White Paper on Defense – nearly four years ago – called for more funds and punch as well as an overhaul of the procurement system to allow professionals to decide on what weapon systems they need. Instead, PM Anwar Ibrahim’s proposal to increase the defense budget by 10 percent to fund procurement will be delayed because of budgetary considerations related to the flagging economy, expected by the World Bank to grow at a mediocre 3.9 percent in 2023, down from an earlier estimate of 4.3 percent in April

===================

THE MALONN LITTORAL COMBAT SHIP (LCS) PROGRAM HAS FACED A NUMBER OF ISSUES, INCLUDING:

• Delayed delivery

The original plan was to deliver the first ship, the LCS 1 Maharaja Lela, in 2019, and all six ships by 2023. However, the program was stalled in 2019 due to financial issues at Boustead Naval Shipbuilding. The program was restarted in 2023, with the first ship scheduled for delivery in 2026 and the remaining four by 2029.

• Design issues

The Royal Malonn Navy (RMN) did not get to choose the design of the ship, and the detailed design was not completed until after 66.64% of the budget had been paid.

• Financial issues

Boustead Naval Shipbuilding was in a critical financial state, and a middleman increased the project cost by up to four times.

• Corruption

A declassified audit report highlighted irregularities in the execution of the program, including the abuse of power and the involvement of a Zainab Mohd Salleh.

• Aging fleet

The RMN's current fleet is outdated, with two-thirds of the ships dating back over 30 years

===================

THE MALONNN ARMED FORCES (MAF) FACES A NUMBER OF CHALLENGES, INCLUDING:

• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze

Transboundary haze has had a grave impact on economic and social activities in MalonnThe Royal Malonnn Air Force (RMAF) faces several problems, including:

• Fleet sustainment

The RMAF has faced challenges maintaining its fleet of aircraft. For example, in 2018, only four of the RMAF's 18 Sukhoi Su-30MKM aircraft were able to fly due to maintenance issues and a lack of spare parts.

• Technological obsolescence

Some aircraft in the RMAF's fleet are reaching technological obsolescence. For example, the Kuwaiti HORNET MALONNs are an earlier block of the HORNET MALONN, which may cause compatibility issues with spare parts.

• Modernization

The RMAF has ambitious plans to modernize its air capabilities to address current and future threats. However, the government's defense modernization budget is limited

Bukan PPA yg ompong tapi TLDM yg ompong. Tak satupun kapal TLDM yg punya rudal 😁😁😁 sampai2 kapal bekas tenggelam dan karatan masih dipakai lagi 😁😁😁😁

BalasHapusMinggir lu miskin parahhhh

Kasihan, beruk hanya bisa nyinyir jirannya. Karena semua aset TLDM kapal usang. 😁😁😁😁😁😁😁

BalasHapusKena tembak Exocet mampus pasukan TLDM beruk tenggelam kapalnya tak bisa berenang digertak Kopaska aja langsung ngacir

HapusBAGUS BERJALAN TIDAK DI MANIPULASI SEPERTI MEF , DIAKALI BIAR DAPAT UNTUNG & PUNYA NAMA DIATAS ORANG LAIN TRIK POPULER UNTUK TUTUP JALAN ORANG SERTA BISA BOHONG BERBUSA².

BalasHapusJIKA MEF DI PATUHI DENGAN DISIPLIN

DEMI MERAH PUTIH , NKRI & BANGSA INDONESIA KAPAL SELAM NKRI 2024 SEKARANG 12 UNIT PUNYA FIGHTER JET MANDIRI & TAK BERHUTANG KE ASING.

Bikin LCS, kapal Stealth yg hanya bisa dilihat jin. Kapal karatan tanpa mesin dan radar. Harga lebih mahal dari POA 😁😁😁😁😁

BalasHapusBwahahaha 😂😂😂, PPA 2025 datang ada yang iri, maklum PPA akan menjadi kapal tercanggih di ASEAN 🤣🤣🤣

BalasHapusItali memang sengaja menjual 2 kapal PPA versi LIGHT PLUS OMPONG.. KERANA Pihak Itali tahu FINCANTIERI baru menghasilkan versi PPA EVO... 🔥🔥🤣🤣

BalasHapus2 KAPAL PPA DOWNGRADE di ganti 2 kapal PPA EVO... PINTAR ITALI... 🔥🔥🤣🤣

KCR 70M = MERIAM 76mm

HapusKCR 70M = MERIAM 76mm

KCR 70M = MERIAM 76mm

KCR-70M didasarkan pada desain FACM-70 Sefine Shipyard, yang merupakan kapal serang cepat 70 meter. Senjata: Meriam Utama 76 mm, 2 x 4 SSM, CIWS 2 X Sistem Peluncur Umpan 12,7 mm

----

KCR 60M = BOFORS 57 MK 3

KCR 60M = BOFORS 57 MK 3

KCR 60M = BOFORS 57 MK 3

TNI AL MERIAM 57mm SEJAK 1980

Meriam kaliber 57 mm sejak dekade 80-an telah identik sebagai sistem senjata utama pada Kapal Cepat Rudal (KCR) TNI AL, yakni dimulai pada adopsi meriam Bofors 57 MK1 di KCR Mandau class buatan Korea Selatan, kemudian berlanjut pada generasi KCR dari FPB-57 series yang menggunakan Bofors 57 MK2, dan yang terbaru, instalasi Bofors 57 MK3 pada KCR 60M produksi PT PAL Indonesia

----

MRO BOFORS 57mm 40mm

MRO BOFORS 57mm 40mm

MRO BOFORS 57mm 40mm

29 November 2021, PT PAL Indonesia telah resmi menyandang status sebagai mitra global BAE Systems Bofors AB (Bofors) dalam pemeliharaan dan perbaikan (MRO) senjata kapal.

----

1 PPA TOTAL VOLCANO = 56 UNIT

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

The OTO Melara 127mm/64cal Lightweight (LW) on the GP variant is part of the VULCANO system which consists of four key sub-systems: the medium caliber 127/64 LW Gun assembly, the Automated Ammunition Handling System, the Naval Fire Control Support and the VULCANO family of ammunition. The system is intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The 127/64 LW - VULCANO is equipped with a modular feeding magazine, composed by 4 drums with 14 ready to fire ammunition each (56 in total), reloadable during firing, and highly flexible in terms of selection of ammunition, independently from their position in the drums. Ammunition flow is reversible as rounds can be downloaded automatically. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km. The rate of fire is 32rds per minute. General Purpose FREMMs are getting the highly Automated Ammunition Handling System for the 127/64 mm gun, which holds 350 127mm shells in addition to the 56 in the four reload drums of the gun turret.

----

GOODBYE = LEKIU KASTURI LAKSAMANA KEDAH PERDANA HANDALAN JERUNG LMS LCS

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

According to Oto Melara, the 127/64 LW is a state of art medium caliber gun suitable for installation on large and medium size ships and intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The compactness of the gun feeding system makes possible the installation on narrow section crafts. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km.

----

EXOCET MM40 (surface-launched) – Block 1, Block 2 and Block 3: deployed on warships and in coastal batteries. Range: 72 km for the Block 2, in excess of 200 km for the Block 3

----

TNI AL = BLOCK 3 : 200 KM

----

TLDM = BLOCK 2 : 72 KM

==========

==========

PERDANA MENTERI = DEFACT KILL PREGNANT WOMEN

LCS = STALLED 13 YEARS

LMS B1 = GUNBOAT NO MISSILE

LMS B2 = DOWNGRADE HISAR OPV

LEKIU = EXO B2 EXPIRED

KASTURI = EXO B2 EXPIRED

LAKSAMANA = GUNBOAT NO MISSILE

KEDAH = GUNBOAT NO MISSILE

PERDANA = GUNBOAT NO MISSILE

HANDALAN = GUNBOAT NO MISSILE

JERUNG = GUNBOAT NO MISSILE

----

SIPRI LCS = DELIVERED : 0 (KONTRAK KOSONG) ......

SAK 70 MK 3 - DELIVERED = 0

MICA - DELIVERED = 0

SHIP ENGINE - DELIVERED = 0

FIRE CONTROL RADAR - DELIVERED = 0

AIR CONTROL RADAR - DELIVERED = 0

Lah ya jelas pintar nya Indonesia ya guys, karena Italia ingin PPA evo maka dengan gerak cepat PPA Indonesia ambil sehingga Indonesia tidak perlu menunggu lama kapal bisa di kirim dengan cepat padahal kapal bru harus menunggu lama

Hapus😂😂😂

MAJU ARAH BANGKRUTNYA🤣🤣🤣

BalasHapusIndonesia beli kapal, wujudnya ada. Beruk beli kapal mahal tak jelas kapalnya ada atau tidak. Ha ha ha ha. Kan bodoh

BalasHapusApa kabar maharajakelah, masih sibuk bersihkan karat ? Ha ha ha ha beli kapal mahal2 tanpa mesin, radar ha ha ha ha

BalasHapusPINTAR PERMAINAN ITALI... JUAL 2 kapal PPA LIGHT PLUS yang DOWNGRADE di ganti dengan 2 kapal PPA EVO... 🔥🔥🤣

BalasHapusFor instance, the PPA EVO can accommodate up to eight 8-cell SYLVER modules: four modules at the bow (32 cells) and four at midship (32 cells), providing a total of up to 64 VLS cells. These cells will include not only the SYLVER A50 type but also the A70 type, which could potentially support the MdCN. The Italian Navy is expected to introduce two PPA EVOs to replace the two ships transferred to Indonesia.

UNREADY ARMED FORCES

HapusUNREADY ARMED FORCES

UNREADY ARMED FORCES

the Malonnn military is today the region’s weakest. It is riddled with corruption, poor planning, and interference by political leaders in procurement, no longer a potent force even in managing low-level intensity conflict at a time when tensions in the South China Sea are higher than they have been since the days of the Vietnam War.

A 2019 White Paper on Defense – nearly four years ago – called for more funds and punch as well as an overhaul of the procurement system to allow professionals to decide on what weapon systems they need. Instead, PM Anwar Ibrahim’s proposal to increase the defense budget by 10 percent to fund procurement will be delayed because of budgetary considerations related to the flagging economy, expected by the World Bank to grow at a mediocre 3.9 percent in 2023, down from an earlier estimate of 4.3 percent in April

===================

THE MALONN LITTORAL COMBAT SHIP (LCS) PROGRAM HAS FACED A NUMBER OF ISSUES, INCLUDING:

• Delayed delivery

The original plan was to deliver the first ship, the LCS 1 Maharaja Lela, in 2019, and all six ships by 2023. However, the program was stalled in 2019 due to financial issues at Boustead Naval Shipbuilding. The program was restarted in 2023, with the first ship scheduled for delivery in 2026 and the remaining four by 2029.

• Design issues

The Royal Malonn Navy (RMN) did not get to choose the design of the ship, and the detailed design was not completed until after 66.64% of the budget had been paid.

• Financial issues

Boustead Naval Shipbuilding was in a critical financial state, and a middleman increased the project cost by up to four times.

• Corruption

A declassified audit report highlighted irregularities in the execution of the program, including the abuse of power and the involvement of a Zainab Mohd Salleh.

• Aging fleet

The RMN's current fleet is outdated, with two-thirds of the ships dating back over 30 years

===================

THE MALONNN ARMED FORCES (MAF) FACES A NUMBER OF CHALLENGES, INCLUDING:

• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze

Transboundary haze has had a grave impact on economic and social activities in MalonnThe Royal Malonnn Air Force (RMAF) faces several problems, including:

• Fleet sustainment

The RMAF has faced challenges maintaining its fleet of aircraft. For example, in 2018, only four of the RMAF's 18 Sukhoi Su-30MKM aircraft were able to fly due to maintenance issues and a lack of spare parts.

• Technological obsolescence

Some aircraft in the RMAF's fleet are reaching technological obsolescence. For example, the Kuwaiti HORNET MALONNs are an earlier block of the HORNET MALONN, which may cause compatibility issues with spare parts.

• Modernization

The RMAF has ambitious plans to modernize its air capabilities to address current and future threats. However, the government's defense modernization budget is limited

Malon bayar mahal utk 6 LCS, rencana AKAN dapat 5. Setelah 14 tahun belum satupun jadi 😁😁😁😁😁😁😁. Lagi sibuk bersih2 karat ha ha ha ha ha kan bodoh betul para beruk ini

BalasHapusMemang aneh Malondesh jelas" bodoh tak sanggup bikin kapal tetap aja mereka cakap pandai 🤣🤣🤣

HapusJelas" miskin tak mampu bayar 17 lender tetap aja Malondesh cakap kaya 😂😂😂

MALONDESH memang KOPLAX

😜😜😜😜

Malaydog bodoh 👎

HapusSerahkan pembuatan LCS pada manusia, kalau yg bikin beruk hanya buang2 uang. Kapal tak akan pernah jadi 😁😁😁

BalasHapusMin ini kapal Malon kandas di Riau. Gara2 karatan kah min ? Kasihan para beruk ini

BalasHapushttps://www.cnnindonesia.com/nasional/20250112203238-20-1186369/kapal-tanker-asal-malaysia-kandas-di-kepri-akibat-cuaca-buruk

KCR 70M = MERIAM 76mm

BalasHapusKCR 70M = MERIAM 76mm

KCR 70M = MERIAM 76mm

KCR-70M didasarkan pada desain FACM-70 Sefine Shipyard, yang merupakan kapal serang cepat 70 meter. Senjata: Meriam Utama 76 mm, 2 x 4 SSM, CIWS 2 X Sistem Peluncur Umpan 12,7 mm

----

KCR 60M = BOFORS 57 MK 3

KCR 60M = BOFORS 57 MK 3

KCR 60M = BOFORS 57 MK 3

TNI AL MERIAM 57mm SEJAK 1980

Meriam kaliber 57 mm sejak dekade 80-an telah identik sebagai sistem senjata utama pada Kapal Cepat Rudal (KCR) TNI AL, yakni dimulai pada adopsi meriam Bofors 57 MK1 di KCR Mandau class buatan Korea Selatan, kemudian berlanjut pada generasi KCR dari FPB-57 series yang menggunakan Bofors 57 MK2, dan yang terbaru, instalasi Bofors 57 MK3 pada KCR 60M produksi PT PAL Indonesia

----

MRO BOFORS 57mm 40mm

MRO BOFORS 57mm 40mm

MRO BOFORS 57mm 40mm

29 November 2021, PT PAL Indonesia telah resmi menyandang status sebagai mitra global BAE Systems Bofors AB (Bofors) dalam pemeliharaan dan perbaikan (MRO) senjata kapal.

----

1 PPA TOTAL VOLCANO = 56 UNIT

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

56 VOLCANO - 55 VESSEL RMN = SISA 1 VOLCANO

The OTO Melara 127mm/64cal Lightweight (LW) on the GP variant is part of the VULCANO system which consists of four key sub-systems: the medium caliber 127/64 LW Gun assembly, the Automated Ammunition Handling System, the Naval Fire Control Support and the VULCANO family of ammunition. The system is intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The 127/64 LW - VULCANO is equipped with a modular feeding magazine, composed by 4 drums with 14 ready to fire ammunition each (56 in total), reloadable during firing, and highly flexible in terms of selection of ammunition, independently from their position in the drums. Ammunition flow is reversible as rounds can be downloaded automatically. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km. The rate of fire is 32rds per minute. General Purpose FREMMs are getting the highly Automated Ammunition Handling System for the 127/64 mm gun, which holds 350 127mm shells in addition to the 56 in the four reload drums of the gun turret.

----

GOODBYE = LEKIU KASTURI LAKSAMANA KEDAH PERDANA HANDALAN JERUNG LMS LCS

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

VULCANO 127mm = 100 KM

According to Oto Melara, the 127/64 LW is a state of art medium caliber gun suitable for installation on large and medium size ships and intended for surface fire and naval gunfire support as main role and anti-aircraft fire as secondary role. The compactness of the gun feeding system makes possible the installation on narrow section crafts. The 127mm VULCANO ammunition family, is composed by Ballistic Extended Range (BER) and Guided Long Range (GLR) ammunition with different multifunctional fuses, sensor and final guidance that extend the range of the gun up to 100km.

----

EXOCET MM40 (surface-launched) – Block 1, Block 2 and Block 3: deployed on warships and in coastal batteries. Range: 72 km for the Block 2, in excess of 200 km for the Block 3

----

TNI AL = BLOCK 3 : 200 KM

----

TLDM = BLOCK 2 : 72 KM

==========

==========

PERDANA MENTERI = DEFACT KILL PREGNANT WOMEN

LCS = STALLED 13 YEARS

LMS B1 = GUNBOAT NO MISSILE

LMS B2 = DOWNGRADE HISAR OPV

LEKIU = EXO B2 EXPIRED

KASTURI = EXO B2 EXPIRED

LAKSAMANA = GUNBOAT NO MISSILE

KEDAH = GUNBOAT NO MISSILE

PERDANA = GUNBOAT NO MISSILE

HANDALAN = GUNBOAT NO MISSILE

JERUNG = GUNBOAT NO MISSILE

----

SIPRI LCS = DELIVERED : 0 (KONTRAK KOSONG) ......

SAK 70 MK 3 - DELIVERED = 0

MICA - DELIVERED = 0

SHIP ENGINE - DELIVERED = 0

FIRE CONTROL RADAR - DELIVERED = 0

AIR CONTROL RADAR - DELIVERED = 0

Paling tak boleh terima kapal OMPONG hanya setahap kapal patroli OPV semahal FREMM FRIGATE bro.... HUTANG pula tu... 🔥🔥🤣🤣

BalasHapusAneh tak disiasat prolehan nya... Harga tak masuk akal.. 🤣🤣

GORILLA kecewa tu bro dengan keadaan negara mereka yang Makin jauh tertinggal sama MALAYSIA... 😎😎🤣🤣

BalasHapusApanya yang maju ❓😂😂😂

BalasHapusUNREADY ARMED FORCES

BalasHapusUNREADY ARMED FORCES

UNREADY ARMED FORCES

the Malonnn military is today the region’s weakest. It is riddled with corruption, poor planning, and interference by political leaders in procurement, no longer a potent force even in managing low-level intensity conflict at a time when tensions in the South China Sea are higher than they have been since the days of the Vietnam War.

A 2019 White Paper on Defense – nearly four years ago – called for more funds and punch as well as an overhaul of the procurement system to allow professionals to decide on what weapon systems they need. Instead, PM Anwar Ibrahim’s proposal to increase the defense budget by 10 percent to fund procurement will be delayed because of budgetary considerations related to the flagging economy, expected by the World Bank to grow at a mediocre 3.9 percent in 2023, down from an earlier estimate of 4.3 percent in April

===================

THE MALONN LITTORAL COMBAT SHIP (LCS) PROGRAM HAS FACED A NUMBER OF ISSUES, INCLUDING:

• Delayed delivery

The original plan was to deliver the first ship, the LCS 1 Maharaja Lela, in 2019, and all six ships by 2023. However, the program was stalled in 2019 due to financial issues at Boustead Naval Shipbuilding. The program was restarted in 2023, with the first ship scheduled for delivery in 2026 and the remaining four by 2029.

• Design issues

The Royal Malonn Navy (RMN) did not get to choose the design of the ship, and the detailed design was not completed until after 66.64% of the budget had been paid.

• Financial issues

Boustead Naval Shipbuilding was in a critical financial state, and a middleman increased the project cost by up to four times.

• Corruption

A declassified audit report highlighted irregularities in the execution of the program, including the abuse of power and the involvement of a Zainab Mohd Salleh.

• Aging fleet

The RMN's current fleet is outdated, with two-thirds of the ships dating back over 30 years

===================

THE MALONNN ARMED FORCES (MAF) FACES A NUMBER OF CHALLENGES, INCLUDING:

• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze

Transboundary haze has had a grave impact on economic and social activities in MalonnThe Royal Malonnn Air Force (RMAF) faces several problems, including:

• Fleet sustainment

The RMAF has faced challenges maintaining its fleet of aircraft. For example, in 2018, only four of the RMAF's 18 Sukhoi Su-30MKM aircraft were able to fly due to maintenance issues and a lack of spare parts.

• Technological obsolescence

Some aircraft in the RMAF's fleet are reaching technological obsolescence. For example, the Kuwaiti HORNET MALONNs are an earlier block of the HORNET MALONN, which may cause compatibility issues with spare parts.

• Modernization

The RMAF has ambitious plans to modernize its air capabilities to address current and future threats. However, the government's defense modernization budget is limited

17 CREDITOR LCS

BalasHapus17 CREDITOR LCS

17 CREDITOR LCS

1. MTU Services Ingat Kawan (M) Sdn Bhd

2. include Contraves Sdn Bhd

3. Axima Concept SA

4. Contraves Advanced Devices Sdn Bhd

5. Contraves Electrodynamics Sdn Bhd and Tyco Fire

6. Security & Services Malon Sdn Bhd,

7. iXblue SAS

8. iXblue Sdn Bhd and Protank Mission Systems Sdn Bhd

9. Bank Pembangunan Malon Bhd

10. AmBank Islamic Bhd

11. AmBank (M) Bhd

12. Affin Hwang Investment Bank Bhd

13. Bank Muamalat Malon Bhd

14. Affin Bank Bhd

15. Bank Kerjasama Rakyat Malon Bhd

16. Malayan Banking Bhd (Maybank)

17. KUWAIT FINANCE HOUSE (MALON) BHD.

===================

THE MALONN LITTORAL COMBAT SHIP (LCS) PROGRAM HAS FACED A NUMBER OF ISSUES, INCLUDING:

• Delayed delivery

The original plan was to deliver the first ship, the LCS 1 Maharaja Lela, in 2019, and all six ships by 2023. However, the program was stalled in 2019 due to financial issues at Boustead Naval Shipbuilding. The program was restarted in 2023, with the first ship scheduled for delivery in 2026 and the remaining four by 2029.

• Design issues

The Royal Malonn Navy (RMN) did not get to choose the design of the ship, and the detailed design was not completed until after 66.64% of the budget had been paid.

• Financial issues

Boustead Naval Shipbuilding was in a critical financial state, and a middleman increased the project cost by up to four times.

• Corruption

A declassified audit report highlighted irregularities in the execution of the program, including the abuse of power and the involvement of a Zainab Mohd Salleh.

• Aging fleet

The RMN's current fleet is outdated, with two-thirds of the ships dating back over 30 years

===================

THE MALONNN ARMED FORCES (MAF) FACES A NUMBER OF CHALLENGES, INCLUDING:

• Logistics

A study noted that the MAF's rapid development has raised questions about its readiness to face threats.

• Budgeting

Malonn's defense budget and spending has been limited by fiscal constraints. The government has been unwilling to cut spending elsewhere or reduce the size of the armed forces.

• Personnel

The MA has identified that military personnel struggle with thinking skills, decision-making, and problem-solving during military operations.

• Procurement

The Malonnn procurement system needs reform. The LCS program has been delayed and reduced in scope.

• Political interference

Political interference and corruption are undermining combat readiness.

• Territorial disputes

Malonn faces territorial disputes and intrusions in its Exclusive Economic Zone (EEZ).

• Transboundary haze